Before you think you won't be able to understand it, just read on! It's actually much less complex than you'd imagine. We will use the Discounted Cash Flow (DCF) model on this occasion. If your investing style includes adjusting positions based on current market conditions and discount rates, then Domino's currently trades at a discount to its intrinsic value.In this article we are going to estimate the intrinsic value of Domino's Pizza Group plc ( LON:DOM) by taking the expected future cash flows and discounting them to today's value. Its asset-light franchise business model allows the company to pursue an aggressive growth strategy of opening up thousands of stores internationally (we highlight this in our previous article). Final Thoughtsĭomino's is the industry leader.

This is because Domino's shouldn't have too much trouble passing the costs onto customers. If you believe long-term inflation will be higher than what the Federal Reserve expects, then you may want to pick 3% growth. In addition, you will need to determine what terminal growth rate makes the most sense to you. If you choose to use the current discount rate, you will need to monitor it more frequently. Therefore, when interpreting this valuation, it's up to you to determine which discount rate to use based on your style. The discount rates that would make Domino's stock trade at fair value at the time of this writing are 5.41% and 6.17%, at terminal growth rates of 2% and 3%, respectively. Therefore, we made the chart below to demonstrate the fair value at each discount rate and terminal growth rate: Furthermore, a slight change in the terminal growth rate also makes a big difference. Of course, discount rates are always changing and not everyone likes to use current discount rates. Since Domino's has an asset-light business model with strong cash flows, the increase in debt poses minimal risk as interest payments can be easily covered.Īs you can see, with single-digit growth, a 2% terminal growth rate, and a discount rate of 4.65%, Domino's is worth $705.24 per share. This is due to a decreased equity risk premium and an increase in the company's amount of debt. In addition, the WACC has also dropped from 4.79% to 4.65%. However, that doesn't seem likely to happen so we reduced it to 21%. Our previous article used a tax rate of 28% because we expected an increase from the Biden administration. The growth rates and expected margins are analysts' estimates.

To value Domino's, we will use a 10-year discounted cash flow analysis. This is an impressive feat that translates into a strong competitive advantage in terms of scale and brand recognition, especially in a fragmented industry. In addition, the carryout and delivery segments are expected to grow faster than the dine-in segments globally.ĭomino's controls 36% of the pizza delivery market and 22% of the total QSR pizza market. In the U.S., the industry is expected to see growth in the low single digits whereas internationally it is expected to be between 3-6%. accounting for almost half of it at $38 billion.

The global QSR pizza is worth $85 billion with the U.S. The fragmentation is less prevalent when focusing on the pizza delivery market as 37% of it is controlled by the same group. The total QSR pizza industry is highly fragmented with 48% of the market consisting of regional chains and independents. Industry Summaryīefore we dive into the valuation, we want to provide a brief summary of the industry.

#Dominos stock valuation free

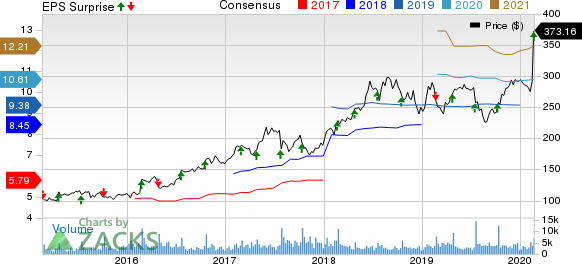

With the price at the time of this writing well above our target, we thought we'd revisit the valuation to see if the intrinsic value has changed.įor a more detailed look at Domino's, feel free to check out our previous article where we outline growth catalysts, risks, and competitive advantages. An Updateīack in December, we wrote an article about Domino's where we valued the company at $503 per share. Domino's will continue to see strong growth going forward, fueled by its ambition to continue opening many more stores. The pizza industry is fragmented which means that the company's size and brand recognition provide it with a competitive edge over the majority of its rivals. ( NYSE: DPZ) is a stable and predictable pizza industry leader with a great long-term track record. Jetcityimage/iStock Editorial via Getty Images Investment Thesisĭomino's Pizza, Inc.

0 kommentar(er)

0 kommentar(er)